Throughout the pandemic, we’ve had a lot of people come to us, ordinarily business owners, or self-employed people who are not able to pay into their pensions that is decelerating their financial independence to retire earlier or get to that work optional point of life that we always talk about.

When that was happening, we looked at different investment opportunities that were on the market and some of them, we were already imploring through our Investment committee.

So what essentially happened is that we went even deeper into the whole process of acquiring property in your pension, because a lot of these business owners and self-employed people, they had pension pots that were just sitting there, that they couldn’t access or they were subject to the volatility of the stock market last year in 2020 and and early 2021 and again, it was good stories and bad stories in the stock market,

But all these pensions that were sitting there where people weren’t able to pay in, we looked at them

and looked at ways that we can basically sweat their capital to produce long term income streams basically, that will provide long term income, but also short-term solutions to the problem of not being able to pay into pension funds, because there’s no cash flow in the business. Just because there’s no cash flow in the business, doesn’t mean that your retirement account can grow through cash flow.

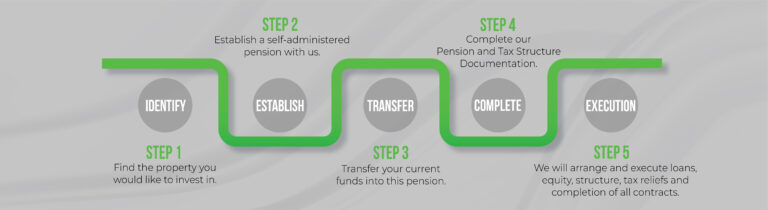

So, essentially, we identified real estate or individual property units that will be more accessible to the ordinary pension investor or the self-employed business owner, where by, they could take that capital, identify your property, and they could then enjoy long term rental income.

Now, what happened there was that a lot of people didn’t have the time to go out and source the property.

They didn’t have time to deal with the government and institutions like the councils and the different social housing schemes that were out there.

So, basically, we package this into a whole process whereby we find the deal, we fund the deal, we manage the deal, we structure the deal, and then we cash flow with the government income streams that are available.

So, again, business owners, self employed people, there now seen the opportunity of buying direct property with their pension funds. The reason being that it’s had so much success is that they can have asset backed income.

The income is also government backed.

There’s tax control around it that there’s no a rental income tax, there’s no capital gains tax on the growth, and again, people are using these properties to produce cash flow in their living lifetime but

there are also seen the advantages of having property in their pension as part of an estate planning tool, and what I mean by that is that the property will produce income while the business owner is alive, but also when they pass on.

The assets within the pension trust can be used for inter-generational wealth transfer and legacy control.

Above that, we’ve also seen an massive influx whereby people have identified that their pension funds probably won’t grow over the next 2 to 3 years, from a contribution perspective, leaving out the the movement of the direction of the stock market.

So, with that in mind, we’ve made this available to all our, self employed people, as well as company directors where by, regardless of how bad business is, regardless of lockdown and different quarantines that are going on around the world, people will be able to enjoy hard currency, hitting their retirement accounts on a monthly basis.

So, what I mean by that is, we’re buying property whereby the average price of getting in is 250 to 300 grand.

There’s income streams coming in, and in certain areas of 25 to 30 grand a year, Somewhere between 2, 2.5 grand per month.

And, again, that income, every month, it’s on one of the government schemes.

We’ll basically hit the bank account in that retirement account. So although you’re couple of thousand euros, a month is not going into your pension, the way it was in 20 19, you’re still stacking cash and capital there’s no contributions going in but there is a rise in the value of the bank balance because the rental income is still going in every month, which is probably keeping your financial independence goal up to kilter, even though there’s no direct fresh contribution going in.

So the fact that you have cash flow rolling in every month means that you’re still getting closer to that financial independence stage where you’re bringing the date back where you have the opportunity to be able to retire on time, or even earlier, than you ever expected. So what people are able to see through out, all the negativity, when it comes to well planning and retirement planning, it’s that while they’re not paying the contributions, they’re still stacking cash. So we are able to engage in a centralised wealth management process whereby we show people how they can still achieve the financial goal of getting to their number and their number is the age that they can afford to retire at. Without ever having to worry about running out of money or the age that they, we’ll have a certain amount of capital within the retirement accounts and personal balance sheet, and family balance sheet, that will allow them to live the life they’ve always taught about.

So again, when it comes to having property in your retirement account, and no income coming into your business, income stream that’s coming off, the rental agreements with the government, is allowing people to achieve their number and that we spoke about earlier.

So, again, people always say, well, how much do we need to have on our pension? So, we call this, and we run webinars on this, called How Much is Enough? So that’s the figure that will allow you a number that we spoke about earlier, that will allow you to live the life that you always wanted to live, without ever having to worry about not having enough money, but not having any more income.

You’re essentially living off your passive assets or dying with too much money because if we die with too much money, we leave problems for estate where by there’s death tax or inheritance tax’s, So again, every month, by having property in your retirement account, you’re just gonna keep stacking cash, and it will allow you to achieve that financial independence.

There’s a couple of income streams that are available and for your retirement account, and that would be counseled back the government backed and also the private market where you can rent out to people who aren’t on any government schemes,

So this isn’t just a social housing enterprise, and it is an income stream that’s available from and multi income streams that could be targeted. So if you’d like any information on how to accelerate financial independence, retire early, please click the link below. Fill out the form and our team will be tortured in 24 hours.

Book a Meeting with one of our experts today, Click on the link below